Well the mini-budget was certainly a fiscal

event. You have probably been inundated with commentary, but we will attempt to

summarise it for you.

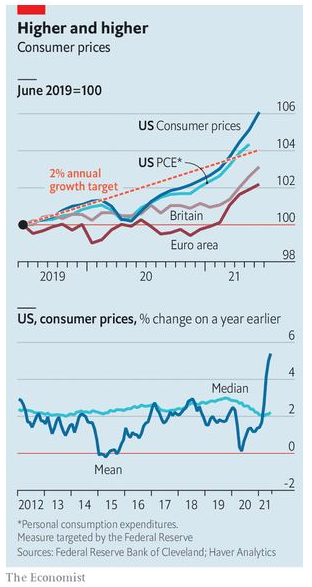

Globally a shift is taking place as we transition from an era of disinflation

to a world of inflation and therefore higher interest rates. At the same time

the picture is complicated by supply chains being modified to compensate for

geopolitical challenges. Central banks only really have one weapon and that is

raising rates to remove liquidity from the markets.

The government wants to stimulate growth. It has already announced the Energy

Price Guarantee (EPG), capping the unit price for households and the Energy

Bill Relief Scheme for non-domestic energy customers.

It is also trying to put more money in our back pockets with the following:

- The Health and Social Care Levy Act provided a temporary increase in National Insurance contributions (NIC). This has been reversed and will come into effect on 6 November 2022.

- The reduction in income tax to 19% from 20% scheduled for April 2024 has been brought forward to April 2023.

- The residential nil rate tax threshold (stamp duty) is increased to £250,000 from £125,000 and for first time buyers £425,000 (£625,000 max) from £300,000.

- The dividend ordinary rate will be reduced back down to 7.5% and the upper rate back down to 32.5% from April 2023.

- Corporation tax will not rise and will stay at 19%.

- The Annual Investment Allowance (AIA) will not be reduced in April 2023.

- Investment Zones to be established and Enterprise Investment Schemes expanded.

- If you have been affected by the change in IR35 this has also been reversed.

However, the Chancellor did not handle the announcements well. He started by dismissing the Permanent Secretary to the Treasury. The Office of Tax Simplification will be closed. He also did not ask the Office of Budget Responsibility (OBR) to review the announcements (therefore it is not really a budget) and then announced that there were ‘more cuts to come’.

The markets did not like the uncertainty and promptly sold Sterling and increased the cost of government borrowing by selling UK government bonds (gilts). This then affected the defined benefit pension industry as the cost of liability matching pensions using derivatives increased. The pension industry then needed to increase the amount of capital (margin) to pay for the increase. This created a vicious recursive circle. The Bank of England (BoE) then stepped in to prop up the gilts market.

Going forward, the BoE only increased the bank rate by 0.5% to 2.25% on 22 September 2022. The next meetings are on 3 November and 15 December. There is a high probability that rates will go up on both dates. This will of course affect mortgage rates and if you are worried give Alastair a call in the office.

It looks like the Chancellor will be trying to balance the books. Simon Clarke, the new levelling up secretary has written to Whitehall departments asking them to ‘trim the fat’ and tackle the ‘very large welfare state’.

The Government’s strategy seems to be based on ‘Reaganomics’ from the 1980s. There will be more volatility in the markets for the foreseeable future; however this is normal market mechanics adjusting to the new regime. We are coming into the Q3 earning season but our companies will be able to pass through the increase in input costs from the energy rises feeding inflation price rises.