Inflation in the UK jumped to 3.2% in August from 2%, its highest level in more than nine years. The Office for National Statistics said that much of the spike was due to a substantial drop in restaurant and café prices last year and meaningful increases this year. The RPI which includes housing costs also jumped to 4.8% from 3.8%.

US – Infrastructure

The US Senate passed a roughly USD 1 trillion bipartisan infrastructure package, including about USD 550 billion in new spending. This is aimed at rebuilding traditional transportation infrastructure, improve access to broadband internet in rural areas and upgrade the electric grid and water systems. The Senate Democrats also approved a USD 3.5 trillion budget resolution.

China – regulation

China released a five-year blueprint calling for increased regulation affecting key parts of the economy. The document signalled Beijing’s intention to draft new laws covering national security, technology, monopolies and education. In the technology sector, new legislation will cover areas such as online finance, artificial intelligence, big data and cloud computing.

ECB revises forward guidance

The European Central Bank (ECB) revised its forward guidance, indicating it would keep interest rates “at their present or lower levels until it sees inflation reaching 2% well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realised progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilising at 2% over the medium term.” The ECB indicated that this process could involve a short period in which inflation goes moderately above this target.

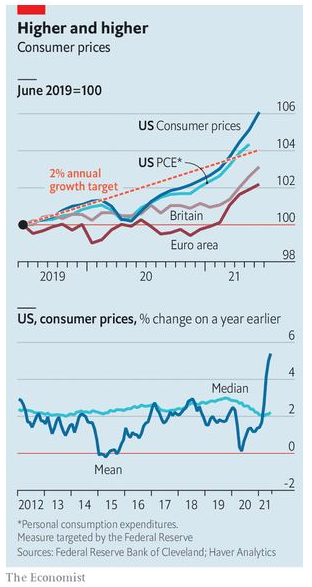

Inflation bubbling up

Consumer prices in America rose 5.4%, well above expectations. There are a small number of huge price rises, such as used cars, whereas the median price change is far lower.

In the UK CPI rose 2.5%. The Office for National Statistics cited increased prices for food, fuel, second-hand cars, clothing and footwear as key factors.

Inflation fears

Last month America’s consumer prices inflation rate rose to 4.2% from 2.6% and this is before the full effects of the Biden stimulus plans take affect. Eurozone inflation accelerated to 1.6% year-on-year in April, up from 1.3% in March, following a sharp rise in the cost of energy compared to the height of the pandemic. UK annual inflation meanwhile more than doubled in April to 1.5% from 0.7% in March, although both remain below central bank target rates of 2% for now.

Budget 2021 – details

The Chancellor of the Exchequer Rishi Sunak has announced that

the bill for addressing the coronavirus pandemic is currently £407bn, which is

equivalent to 10x HS2 projects or 20 Crossrail’s.

Tax thresholds

The key financial changes announced in the budget are as

follows:

The basic rate income tax threshold has been slightly increased from April 2021

to £12,570 from £12,500 and the high rate threshold to £50,270 from £50,000.

The thresholds will then stay at these levels for the following 5 years.

The inheritance tax nil-rate band will remain at the existing level of £325,000

and also the residence nil-rate band of £175,000 until at least 2026. The

residence nil-rate band taper will continue to start at £2 million.

The capital gains annual exempt amount has also been frozen at £12,300 until

2026.

Dividends also escaped. The tax-free dividend allowance has been kept at

£2,000.

Pensions

The pension lifetime allowance has also been frozen at £1,073,100 until 2026.

The state pension will however rise by 2.5% next tax year and the triple lock

will remain in place.

Property

The 0% stamp duty land tax holiday on the first £500,000 has been extended

until 30 June 2021. The threshold will then be reduced down to £250,000 for a

further 3 months and then return back to £125,000 from October.

Lenders have been withdrawing from providing low-deposit mortgages. Therefore

to help first time buyers the government is guaranteeing 95% loan-to-value

mortgages up to £600,000.

Companies

From April 2023 corporation tax will increase for companies with profits above

£50,000. Tapering from 19% up to 25% above £250,000. This will affect the UK

companies, but as it is progressive and can be offset by ‘super deduction’ on

business investment as companies investing can benefit from a 130% first-year

capital allowance.

IR35 changes delayed from last year will go ahead in April 2021. Companies must

now collect income tax and NIC from the contractor’s fee and pay it over to

HMRC.

The furlough scheme will be extended until October 2021. However, employers

will be asked to contribute 10% in July and increased to 20% in August.

The trading loss carry-back rule has also been extended from the existing one

year to three years.

The VAT reduction for the UK’s tourism and hospitality sector has been extended

until October 2021 and reduced rate of 12.5% will then be applied until April

2022.

Business rate reliefs have also been extended to July 2021 and then a reduced

rate of 66% until April 2022.

Even more stimulus

The Senate finally passed a budget resolution moving forward legislation authorising the $1.9 trillion stimulus the President requested. This takes the amount of the global stimulus to above $22 trillion.

OPEC cuts oil supply

Saudi Arabia shocked the markets by raising pricing for oil customers after cutting supply by 1 million barrels a day in February and March.

Even more fiscal stimulus

Japan announced a new ¥73.6tn ($708bn) stimulus package to further support the recovery. The new stimulus package will include subsidies for green investment and spending to accelerate digitalisation.